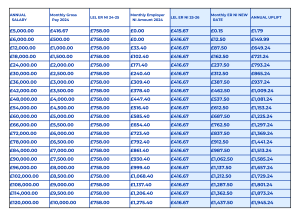

In the Autumn budget, the Chancellor, Angela Reeves announced changes to employer National Insurance contributions. These changes take effect from April 2025 but do you know how they impact your business? A brief summary is as follows:

- The contributions made by employers for National Insurance are rising with rates increasing from 13.8 to 15%.

- Employers will pay National Insurance on more of an employee’s earnings as the threshold is reducing from £9,100 to £5,000

- Employment allowance will increase from £5,000 to £10,500 to help smaller organisations reduce their contributions

To help employers understand the contribution they will have to pay on an annual salary, our expert, Tina Pontin, has put together this helpful chart. We hope this is useful in understanding how the costs associated with these changes will affect your business.

If you would like to find out more about the payroll services we offer or read about outsourcing your payroll, please use the buttons below:

Barrons Chartered Accountants offer wide-ranging services. However, no matter what service we deliver, we never forget the importance of working with you personally to understand your business needs.

We have a wealth of knowledge inherent in our in-house experts and consultants. We seek to provide a pathway to robust confidential payroll processing where relationships with HMRC are maintained to the highest levels of compliance. Do get in touch if we can help you and your business in any way.